Fox Valley home prices January 1 2022

Fox Valley home prices January 1 2022. Happy New Year! We wish you a healthy, prosperous and happy year ahead. Hopefully you will keep an eye on the market with us and jump in when you are ready. Just let us know and we will be happy to help with all of your real estate needs.

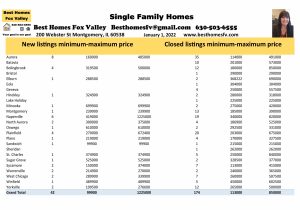

The last week of the year was slow with new listings. 42 this week compared to 43 the previous week. That is 2 holiday weeks in a row. Now to take down all the decorations and get back to normal.

Closed listings for this last week of the year was slightly down. 174 this week compared to 186 the week before.

Take a look at the communities with the most activity this week:

Aurora-New 8 $160,000-$485,000

Closed-35 $114,000-$491,000

Batavia-Closed 10 $201,000-$573,000

Bolingbrook-New 4 $319,500-$500,000

Closed-12 $180,000-$850,000

Montgomery-New 1 $239,900

Closed-13 $185,000-$390,000

Naperville-New 6 $419,000-$1,225,000

Closed-19 $340,000-$820,000

Plainfield-New 4 $270,000-$672,400

Closed-20 $203,000-$675,000

Yorkville-New 2 $199,500-$276,600

Closed-12 $265,000-$500,000

Let us know what community you are looking for and we can get you set up to receive listings as they hit the market.

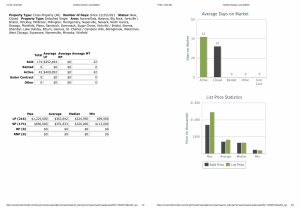

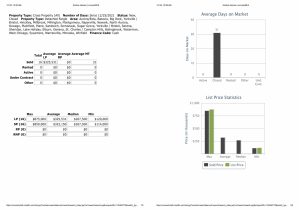

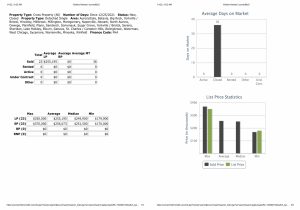

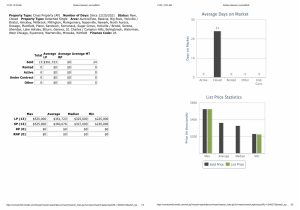

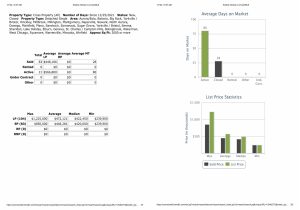

Financing most used, median prices and 2,000 square feet or more

Median list price of single family homes this week was $324,950, last week $339,000.

Closed median price this week was$326,000, last week $335,500.

Conventional financing was used to close 121 homes this week with a median price of $335,000, last week 138 at median price of $350,500.

Cash was used to close 16 homes this week with a median price of $267,500, last week 11 at median price of $291,500.

FHA financing was used to close 23 homes this week at median price of $251,500, last week 28 homes at median price of $256,500.

VA financing was used to close 13 home this week at median price of $327,000, last week 7 homes at median price of $361,000.

People are looking for homes with more square footage than they currently have. 83 homes closed this week that were looking for 2,000 square feet or more at a median price of $420,000, last week 99 homes at median price of $412,500. The minimum price of home closed this week of 2,000 square feet or more at a price of $239,900, last week $239,000.

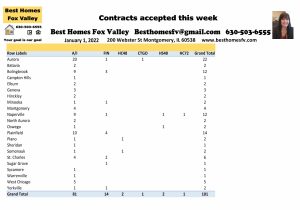

Contracts accepted this week

Contracts accepted this week were down. 101 this week compared to 120 the previous week.

Look at the communities seller’s accepted the most contracts:

Aurora-22 Bolingbrook-12

Naperville-12 Plainfield-14

No short sales were accepted by seller’s this week. That does not mean that there are not any out there on the market. Most homes right now have appreciated enough that even if you are struggling you can payoff the loan and might even have money left over.

Seller’s accepted contracts that are contingent on the buyer closing on their current home. 1 with a kick-out clause of 72 hours and 2 with 48 hours.

Also, seller’s accepted contracts that are contingent on the buyer selling and closing on their current home. 2 with a kick-out clause of 48 hours.

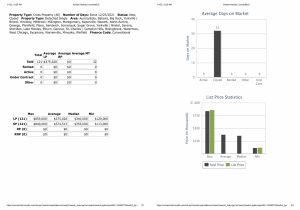

2021 by the month and a look back at 2020 and 2019

2021

Month New Closed Contracts accepted

January 543 649 829

February 561 604 778

March 993 1099 1455

April 1006 926 1387

May 1088 1288 1289

June 1450 1686 1671

July 1118 1182 1210

August 1109 1203 1170

September 1083 1411 1251

October 715 973 930

November 557 854 931

December 349 1044 652

Totals 10572 12919 13553

2020

January 1105 566 858

February 1267 529 1024

March 1186 707 1079

April 648 786 775

May 1352 1010 1444

June 1232 908 1534

July 1417 1453 1852

August 1037 1335 1436

September 1176 1503 1503

October 843 1116 1159

November 567 985 699

December 513 971 783

Totals 12343 11869 14146

2019

January 878 407 568

February 1032 463 832

March 1731 915 1375

April 1594 792 1307

May 1645 995 1280

June 1643 1253 1218

July 1423 1008 1090

August 1585 1330 1196

September 1164 765 869

October 1041 738 776

November 897 946 839

December 496 638 497

Totals 15129 10250 11847

Inventory of homes for sale decreased all 3 years. Closed homes went up all 3 years and so did prices because of the decrease in inventory. This give you a good look at why prices are rising. There are not enough homes built to satisfy the demand. This is not just locally. It is nation wide. More homes need to be built or commercial property that is vacant needs to be modified to accommodate housing needs.

Check back with us every Saturday for the real estate market update. At the end of each month we take a look back at the previous 2 years so you can see how the market is going.

Contact us

Call us at 630-503-6555 with all your real estate questions. Your goal is our goal. We will do everything we can to help you reach your goal.

Is 2022 the year you will want to make a move? Request a home valuation to see what your home is worth in today’s market. We will give you an estimate and a net proceeds that shows you the expenses to sell. This will be updated when an offer comes in and we know all the terms. Let us know a little bit about your home and what has been updated recently.

Thinking of buying a home this year? Plan in advance it might take a while for the right home to come on the market that meets your needs. Contact a loan officer and get them all your financial documents so they can get you pre approved. They will give you a letter showing what price will work for you and what type of financing so we can show the seller that you do qualify for their home when the time comes to make an offer. You need to be ready to go in this market.

Resources:

- Types of loans and the process

- VA loans and the requirements

- Current interest rates

- Down payment assistance

- IHDA programs

Check with your loan officer for the rates they are willing to give you with your current credit score. They can help you increase your score if needed.

If you need recommendations for loan officers, real estate attorneys or home inspectors we would be happy to give you a few to contact and you can decide who best to work with.

Look for us on Facebook and click on the “shop now” to search for homes anytime you like. Look for the drop down arrows to change what type of home and other options.

All data is from our MLS MRED, LLC

Fox Valley home prices January 1 2022. Happy New Year! Have an awesome week ahead.

Kristine Heiman, SFR, SRS, AHWD, C2EX

Designated Managing Broker

Best Homes Fox Valley

200 Webster St

Montgomery, IL 60538

630-503-6555 ext 101